Investment Opportunities

SMG Capital’s (SMG) primary investment objective is to invest in build-to-core equity investment opportunities for development or value-add repositioning of residential and commercial real estate assets. SMG Capital seeks to invest in multi-scale projects situated on prime development or redevelopment sites that, once developed, can be stabilized into well-leased, high-income producing core investments.

SMG targets all residential and commercial real estate asset classes and projects generally located in urban infill locations within the top ~30 U.S. markets.

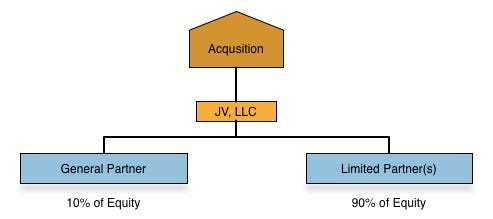

SMG explores opportunities to implement Co-GP Equity/Debt to acquire or fund development transaction. The term “Co-GP Equity/Debt”, sometimes known as “Co-Developer Equity/Debt”, refers to a part of the capital stack of a real estate project created when two general partners enter into a joint venture in order to co-develop or co-fund and jointly lead the execution of a single real estate joint venture project (which may include multiple underlying properties). SMG Capital may provide any or all of the following assistance to an operating partner:

- Providing guarantees required by lenders, including the Completion Guarantee;

- Underwriting the real estate development;

- Helping to formulate the real estate development’s business plan;

- Structuring and securing financing for the real estate development;

- Assisting with the management of the development post-closing; and

- Executing on the realization or disposition of the developed real estate asset in order to harvest returns.

Direct investments/operating assets

Our goal is to develop good businesses into great ones. Our aim is that the businesses we invest in become leaders in their fields. As an investment partner, we combine global reach and local networks to realize the potential of a variety of assets in growing markets with supportive long-term macro trends.

We are active owners and take a hands-on approach to working with the companies and assets we invest in to support them in expansion, operational improvements and the optimization of their overall governance structure. In addition, our deep sector and industry expertise enables us to implement a variety of more bespoke value creation initiatives aimed at generating sustainable value over time.

In private real estate we focus on:

- Buying below replacement cost

We target assets with low valuations located in rebounding markets that can be repositioned and then leased-up by under-cutting market rents. These opportunities typically arise as a result of ineffective management, inadequate leasing or physical deficiencies – all issues that we can address. - "Buy, fix, sell"

This approach typically targets older buildings in great locations that are in need of owner-oriented asset management initiatives including capital expenditure, repositioning, lease-up and the implementation of building efficiencies to capture rental and pricing differentials. - Develop core

The rapid transformations taking place in many major cities across the globe offer plentiful opportunities to execute a "develop core" strategy. We focus on building ground-up assets that meet end-user demand and appeal to core investors.

This is the SMG® Way.

Institutional Private Equity Real Estate (iPERE)

Institutional private equity real estate (iPERE) can be described as high-quality commercial properties that are usually congregated in large investment portfolios managed professionally on behalf of third-party owners or beneficiaries.

Our Strategy

Adding real estate to a traditional investment portfolio of stocks, bonds, and treasury bills introduces a historically non-correlated asset that may reduce risk and enhance overall return. The Fund provides access to a diversified holding of large, private, real estate securities typically available only to institutions (and without the large minimum investment and long holding period normally required).